Jill On Money: Bond market forces Trump to blink

It has been a period of time (just 2.5 weeks, if you can believe it!) since President Donald Trump displayed his posterboard tariff plan in the Rose Garden on April 2nd. Financial markets have been roiled, trading partners have volleyed back tariffs of their own, and one week after the original announcement, the president backed down from some of the more extreme tariffs that he had originally laid out.

Although much attention was placed on the stock market gyrations, it was the bond market that caused Trump to blink. As a reminder, a bond purchase is essentially a loan to an entity, which can be a government, a state, a municipality, or a company.

The loan is established for a predetermined period, at a fixed rate of interest. Borrowers are on the hook for interest payments, either at periodic intervals (usually every six months), or at the end of the agreement, when they are required to repay the obligation in full.

Of all the bonds available, those issued by the U.S. government are seen as the safest, because it has generally been unthinkable to consider that the U.S. government would not repay its obligations.

Typically, in moments of stock market frenzy or when recession fears spike, investors will sell risky assets, like stocks, and pile into the safety and security of U.S. government bonds. In fact, this is what happened in the two days after the reciprocal tariffs were announced. Prices jumped and the yield on the 10-year treasury dropped below 4 percent, a level not seen since last October.

The global financial system relies on a well-functioning U.S. bond market, but from April 7-9, the bond market showed signs of extreme stress. All of the sudden, investors were selling government bonds, pushing long-term interest rates higher. Economic historian Adam Tooze points out that the bond sell-off was “amongst the largest ever seen...the largest since 1982.”

There were likely a few reasons for the reversal, including that some investors were selling bonds to cover stock market losses; hedge funds were unwinding complicated strategies that moved against them; and foreign investors were selling in response to the start of the tariff war. Nobel-prize winning economist Paul Krugman said the Trump tariffs “have disrupted the plumbing of the financial system, leading to soaring interest rates on U.S. government debt.”

Trump officials, who cavalierly discounted the initial sell-off in the stock market, were forced to acknowledge that the much larger bond market reaction was flashing a big warning sign that read “STAND DOWN ON TARIFFS!” and that’s exactly what Trump did when he blinked and announced the 90-day pause on April 9.

Even so, tariff levels remain steep. According to analysis from the Budget Lab at Yale University, the U.S. effective tariff rate level is the highest since 1933. Tariffs are likely to slow down growth, increase prices and lower profits, which is why recession calls are increasing. Whether or not we get there hinges on the ultimate level of tariffs and how long they remain in place.

One big hurdle will be both consumer and business confidence, both of which have taken a nosedive recently. On April 11, the University of Michigan reported that its Consumer Sentiment Index had sunk to a level that is weaker than it was during the 2008 Financial Crisis.

As we have learned over the past two weeks, sentiment can shift on a dime, plunging markets into chaos, or propelling them higher. That’s a good reason to hold steady and avoid making any changes in your retirement or investment accounts, unless you need the money within the next 12-18 months.

_____

_____

========

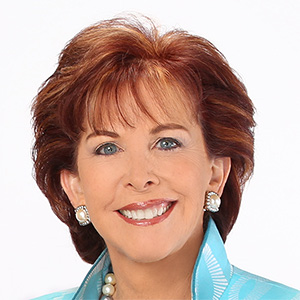

(Jill Schlesinger, CFP, is a CBS News business analyst. A former options trader and CIO of an investment advisory firm, she welcomes comments and questions at askjill@jillonmoney.com. Check her website at www.jillonmoney.com)

©2025 Tribune Content Agency, LLC

Comments