Taiwan extends short-selling curbs amid Trump tariff uncertainty

Published in News & Features

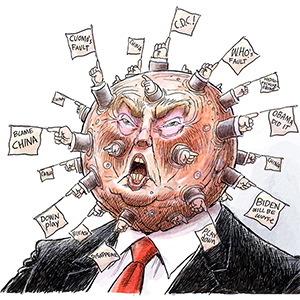

Taiwan again extended its restrictions on short-selling to curb market volatility, amid ongoing uncertainty over Donald Trump’s tariff measures.

The Financial Supervisory Commission in Taipei reimposed a limit on the volume of intraday short-sell orders for borrowed securities, capping it at 3% of a stock’s average daily trading volume over the preceding 30 days, according to a statement on Saturday. That represents a sharp reduction from the usual 30% limit.

The measure has been in place since April 7. Taiwan’s stock market — as measured by the Taiex benchmark — declined 0.68% last week after falling 8.31% the previous week, the FSC said, adding that the market has become more stable.

“The FSC will continue to monitor developments in international financial markets and domestic securities trading, conducting real-time assessments,” the regulator said. “Should significant changes arise, the Commission will promptly respond and adjust relevant measures to safeguard market stability and protect investor interests.”

Taiwan’s financial regulator implemented similar curbs during past periods of heightened market volatility, most recently in 2022. The last full suspension of short-selling occurred in 2008 during the global financial crisis.

The Taiex has fallen 15.8% in the year to date, versus a 6.25% decline in the MSCI World Index. Stocks plummeted globally in early April after Trump said the U.S. would impose steep tariffs on much of the world. He changed course on April 9, pausing many of the higher import tariffs for 90 days.

©2025 Bloomberg L.P. Visit bloomberg.com. Distributed by Tribune Content Agency, LLC.

Comments