Women helm more companies than ever. Why is it still so hard for them to get funding?

Published in Women

Though venture funding involves hard numbers—like financials and market data—the process of receiving a check worth millions of dollars is surprisingly less scientific. Venture firms wade through countless emails and elevator pitches. Armed with funding entrusted to them by their partners, venture capitalists must try to diffuse the risk for investors while gaining as much value from the companies as possible.

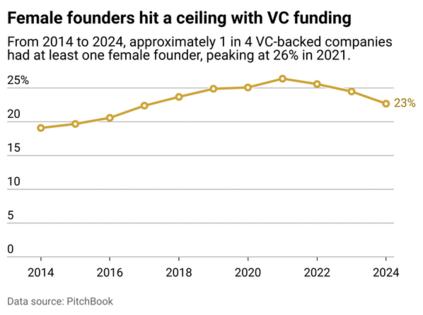

The result is a rather unregulated system, one that involves networking and intuition. Consequently, the venture ecosystem suffers from the same problems many other industries do: Startups helmed by women receive far less funding than those run by men. According to the Harvard Kennedy School, venture capital is a male-dominated field, allowing unconscious bias to negatively affect women founders.

In 2023, at least 5% of all startups in the United States were founded by women, the Global Entrepreneurship Monitor estimates. Yet they receive only about 1.8% of venture capital funding according to PitchBook data. To discover where the gaps lie, Company Insights examined data from PitchBook's NVCA quarterly report and explored the gender disparities in startup funding.

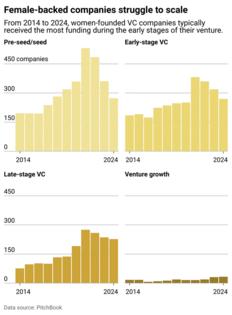

PitchBook found that funding for women-led startups has dropped off since reaching a high of $64.5 billion in 2021. While first-time financing for men dipped between 2016 and 2021, the recipients that benefited were largely companies founded by a mix of genders rather than all-women founders.

The situation doesn't get any better as a business matures. As women-led startups continue to grow and develop, they are less likely to receive late-stage funding when compared with earlier funding stages. Late-stage funding rounds often involve large amounts of capital in the $100 million range and allow companies to scale. In some cases, these companies may even go public on the stock market. While pre-seed and seed rounds are often dedicated to startups in their infancy—companies that don't have any revenue and are still in their ideation phase—late-stage companies often pull in consistent revenue.

"One of the things that might be why they're not securing later stage funding is network limitations, meaning that female founders might not know those people that provide the later stage capital," Melinda Moore, a Los Angeles entrepreneur and limited partner at Coyote Ventures, told Stacker.

Over the years, there has been an increased effort in the venture community to combat this imbalance. From January 2012 until December 2022, Moore co-led Tuesdaynights, a networking event for women entrepreneurs and venture capitalists that allowed both parties to bridge the gender gap. Other venture firms have popped up to specifically fund women founders, like Halogen Ventures, Emmeline Ventures, and digital health-geared Coyote Ventures.

Visit thestacker.com for similar lists and stories.

Comments