Consumer

/Home & Leisure

/ArcaMax

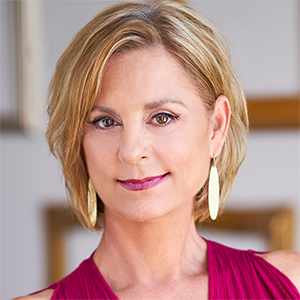

Everyday Cheapskate: Take the Sure Thing, or Straighten Up and Fly Right

Dear Mary: We live in Nevada and own a second home in Arizona. My husband wants to sell the Arizona property and then use the proceeds to pay off our credit debt, auto loan and home equity loan on the Nevada property -- about $165,000 total.

I disagree. I think we should rent the Arizona property to generate income and benefit from its future ...Read more

10 best low-risk investments in 2025

With the economy slowing and President Donald Trump’s tariffs likely to stoke inflation, investors face various risks. Building a portfolio that has at least some less risky assets in it can be useful to help you ride out volatility in the market.

The trade-off, of course, is that in lowering risk exposure, investors are likely to earn lower ...Read more

Seattle used to have affordable housing. What happened to it?

SEATTLE — In 2014, new owners purchased Panorama House, an 18-story building on First Hill, and to renovate the decades-old apartments, they kicked out 200 tenants, many of them elderly and retired.

Explicitly or not, they were making room for a deluge of younger renters moving to a city unequipped to fit newcomers. Many transplants had an ...Read more

Big Bay Area real estate brokerage dealt a rebuff in private listing campaign

SAN JOSE, Calif. — In what consumer advocates say is a win for homebuyers and sellers, the National Association of Realtors, the major trade association representing the real estate industry, has largely rebuffed a push by the largest U.S. brokerage to end a policy requiring agents to publicly list properties for sale on local online databases...Read more

6 totally useless pieces of investing advice that you should probably ignore

Key takeaways

— Day trading and one-off investment picks may not pan out and could derail your investing progress.

— Permanent life insurance and other investments with “guaranteed returns” aren’t clear-cut winners. Contrary to what some finfluencers may claim, no return is 100 percent guaranteed.

— Over-investing in precious ...Read more

Everyday Cheapskate: Clever, Genius and Just Plain Brilliant Housecleaning Hacks from the Pros

Over the years, I've picked up my fair share of housecleaning tricks -- some from sheer trial and error, others from seasoned professionals who make scrubbing and tidying look like an art form. The best cleaning hacks aren't just about getting things spotless; they're about getting there cheaper, better, faster and without pulling a muscle.

So ...Read more

Everyday Cheapskate: Yesterday, I Turned Back Time

I reset my lawn sprinkler timer, which was more than an hour off due to the spring ritual known as daylight saving time. Rather than move it one hour ahead, I decided to let it run backward. It was mesmerizing to see time back up -- so much so that when I reached the desired time, I didn't stop. I let it go back another 24 hours and then another...Read more

Everyday Cheapskate: Everything I Know About Negotiation I Learned in Order to Survive

Driven to save myself and my family from financial ruin, I jumped into the deep end of the industrial real estate industry. I knew nothing about negotiating. All I knew was that I had to close deals -- bringing interested parties together, getting them to agree and seeing that everyone walks away a winner.

I no longer sell real estate, but I ...Read more

Everyday Cheapskate: Broke? Can't Save? Oh, Yes You CAN!

How's your health? Not your physical fitness, but your financial well-being. For most of us, how much we earn tells us how we're "feeling" financially. But your income is only one part of the equation. How much of your income do you actually keep?

Not very much, I'll bet. Your income is low, you say; you've got bills to pay. Rents are sky-high;...Read more

Everyday Cheapskate: Spring Ahead!

Believe your eyes -- it's spring! Time to bid farewell to the snowblower, gas up the lawnmower and let the sunshine in (whether your allergies approve or not). And what better way to welcome the season than with a few simple money-saving tips to freshen up your home and yard?

DIY GLASS CLEANER

Forget expensive window sprays -- your pantry has ...Read more

Everyday Cheapskate: How to Freeze Eggs, Dairy Products and More

I'm sure my supermarket is not the only grocery store with an area in the back I call "My Bargain Bin." It's refrigerated and features some dandy bargains, especially on perishable items approaching that "sell by" date. There are no limits on the number of items I can load into my cart -- all of them with ridiculously low, rock-bottom prices.

...Read more

Everyday Cheapskate: Who Needs Balance?

Dear Mary: What does it mean to "balance" my bank account? How do I do that? Why should I? I really appreciate you answering my question. I'm sure I should know this, but honestly, I don't. -- Josey

Dear Josey: This is a great question, and I'm sure you'd be surprised to know just how many of your fellow readers want to know the same thing!

To...Read more

Everyday Cheapskate: Before You Jump Into HEL, Consider Your Options Very Carefully

Dear Mary: We have decided to pay off a bunch of bills and do some much-needed repairs on our house. Can you tell me the difference between a home equity loan and a home equity line of credit? Which would be better? -- Scott

Dear Scott: With a home equity loan, or a HEL, you walk away with a check for the full amount of the loan and a second ...Read more

Everyday Cheapskate: Why Are We So Gullible?

The claims are so over the top, they practically sparkle. The messages flood in from every direction -- email, TV, radio, social media and sometimes even hand delivery by a very enthusiastic "friend."

"Make over half a million dollars every four to five months from home with a one-time investment of just $25!"

"Become a millionaire overnight -...Read more

Everyday Cheapskate: What Is a Grace Period, and How Does It Work?

Dear Mary: Is there a law that says how long the grace period must be? (And if you don't mind, exactly what IS a grace period?) -- Justin

Dear Justin: In the world of lending and borrowing, the "grace period" is the number of days between the time you make a credit card purchase and when you will begin to pay interest on that short-term loan.

...Read more

Everyday Cheapskate: Financial Harmony Is More About Trust Than Money

Dear Mary: My wife and I have been married for three years. She has memorized my credit card information.

This is my personal account, and she is not listed as an authorized user. However, she charges to it without my knowledge, and it's getting out of hand. About a year ago, I took a loan from my 401(k) and paid off the balance, only to have ...Read more

Everyday Cheapskate: Homemade Ice Melt for Steps, Walkways and Driveways

Got ice and snow on top of super cold temperatures this winter? "Everyday Cheapskate" reader Jennifer does, and she wrote, "Do you have a solution for melting ice and snow on walkways, driveways, steps and windshields?"

I do, and at least one of these homemade recipes is sure to come to Jennifer's rescue, and quite possibly yours, too

All of ...Read more

Everyday Cheapskate: 27 Grocery Shopping Tricks to Keep More Cash in Your Pocket

Next to your rent or mortgage payment, food is probably your biggest expense. Don't believe me? For the next 30 days, track every nickel you spend to feed your face, then tell me it doesn't add up to one boatload of cash-ola.

Every dollar you don't spend on food is a dollar you get to keep for something else -- like knocking down that student ...Read more

Everyday Cheapskate: The Inside Buzz on Batteries

Little things mean a lot -- like the two words "batteries included." Just knowing they're in there somewhere means less hassle and one less thing to buy. But face it. The initial powering-up of a battery-operated device is a minor concern. It's the cost of keeping it going for years to come that should be considered.

The commercials are ...Read more

Everyday Cheapskate: The Most Overlooked Type of Insurance

Insurance is a funny thing. You learn all you can, shop diligently, scrape together the money to pay for it and then hope you'll never have to use it.

In addition to health and automobile coverage, most people insure their lives so that in the event of their death, those who depend on their income will not be left high and dry.

Term life ...Read more

Inside Consumer

Popular Stories

- How 'unretiring' to go back to work can affect your Social Security benefits

- Real estate Q&A: What happens to our mother's house after she died without a will?

- Chicago residential developer now negotiating to buy the entire Lincoln Yards site, which is still mostly empty

- Seattle real estate industry feuds over private home listings

- US spring homebuying season has its weakest start in five years