Erin Lowry: The college talk more parents need to have with their kids

Published in Op Eds

What is the U.S. without its federal Department of Education? The potential answers worry parents, educators, students and policy experts after President Donald Trump’s executive order to shut down the agency.

The intended — and unintended — consequences of the order will be felt for generations. High on the list of effects, because of the department’s role as the lender of federal student loans, should be a wariness about trusting the benefits available to borrowers.

Historically, federal student loans have been superior to their private counterparts. They offer lower interest rates; private student loans have the potential for fees nearly double that of the 6.53% for undergraduate direct student loans. The advantages continue with options like income-driven repayment plans, forgiveness programs, and the ability to defer or enter into forbearance during hard times. A notable example of the latter was the COVID-19 payment pause, which allowed borrowers to suspend payments without penalty or incurring interest — a benefit initially authorized by Trump in his first term.

It was a welcome relief. One in four adults under 40 have student loan debt, with the median borrower carrying between $20,000 and $24,999, according to a Pew Research Center analysis. The burden jumps up to 36% for people who hold at least a four-year degree.

But the president’s move to disband the DOE could throw the entire system of federal student loans into chaos.

One major concern is the possibility of stalled repayment and forgiveness applications as the agency’s staff is decimated by DOGE. Another issue is the legality of Trump’s (current) plan to move the responsibility of handling the nation’s $1.7 trillion student loan portfolio to the Small Business Administration, which has been questioned by experts. Alternatively, private lenders could step in to fill the void.

But it’s unclear if privatizing federal student loans would mean a complete eradication of federal perks as the government would likely still function as a backer.

All of this student loan uncertainty is on a collision course with the threat of a recession. Economic fears are easy to stoke during times of volatility, but the odds of one in the next 12 months are as high as 65% if Trump doesn’t cancel — not just pause — most of his tariff decisions, according to Goldman Sachs Group Inc.

I was a freshman in college when the housing market started to collapse in 2007, so I’m all too familiar with the fallout a recession can cause for college-aged kids. Students who had barely started their higher education journeys were suddenly dropping out as parents lost jobs and could no longer help cover the cost of tuition. Others took on an unexpected amount of loans to pursue their collegiate careers. If the past is prologue, it’s important to note that borrowing went up 25% during the 2008-2009 academic year. At least at that time, federal student loans were not caught in the political crosshairs.

There is no certainty a recession will happen, but a trade war will result in an increased cost of goods, which means less discretionary income for families across the socioeconomic spectrum.

With the administration’s erratic decision-making affecting different households, it’s important that people find things they can control. When it comes to student loans, that may look like parents of current or college-bound kids having frank conversations with each other — and with their children — about the affordability of tuition in a more stressful economic climate.

At the very least, parents need to be honest with their kids about how much they can afford to contribute toward their higher education. The discussion may lead to the following decisions, which I think are in the best interest of most college-bound: attend in-state schools or pick the college offering the best scholarship package (even if it’s not their top choice). They can also consider the local community college and then transfer to a four-year institution, which can save thousands of dollars. Private non-profit four-year schools were almost four times the cost of their in-state counterparts in 2024, according to the College Board’s Trends in College Pricing report. The latter averaged a modest $11,610 for tuition and fees.

Aside from deciding where to attend, a key objective of that conversation should be to make sure that college-bound young adults understand the long-term financial consequences of student loans. Graduating with little to no debt, even from a lesser-known school, provides a better launchpad into adulthood and allows for greater risk early on in a career.

The debt-free goal seems even more imperative when you consider that the GOP targeted and successfully blocked Biden-era student loan debt relief efforts, which left 8 million borrowers enrolled in the Saving on a Valuable Education (SAVE) program in legal limbo. In Trump’s second term, he aims to further erode the option to seek forgiveness. His administration plans to block Public Service Loan Forgiveness (PSLF) access – a program created and signed into law under President George W. Bush — to those who have worked for non-profits it deems distasteful or, to quote the executive action, “have a substantial illegal purpose.” Many of the outlined examples are vague enough to be used against a wide variety of organizations.

Amid all this uncertainty, the best course of action is practicality. Gone are the days when borrowers could position student loans as “good debt” used for “investing in themselves.” The new reality is that dismantling the DOE could be another significant blow to the American belief that hard work and higher education provide a path to financial stability.

____

This column reflects the personal views of the author and does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

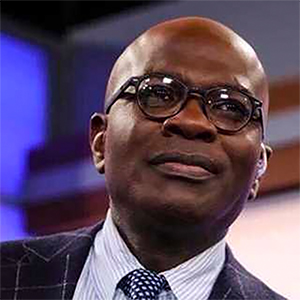

Erin Lowry is a Bloomberg Opinion columnist covering personal finance. She is the author of the three-part “Broke Millennial” series.

©2025 Bloomberg L.P. Visit bloomberg.com/opinion. Distributed by Tribune Content Agency, LLC.

Comments