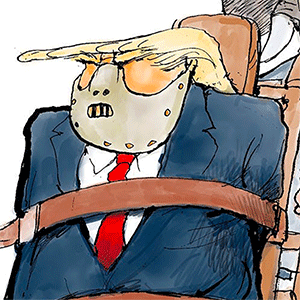

Trump berates Fed's Powell, urges 'termination' for slowness

Published in Political News

President Donald Trump said Federal Reserve Chair Jerome Powell’s termination from his position can’t come quickly enough, arguing that the US central bank should have lowered interest rates already this year, and in any case should do so now.

Trump, derisively nicknaming the Fed chairman he nominated in his first term as “Too Late,” wrote in a post on the Truth Social platform Thursday morning that “Powell’s termination cannot come fast enough!”

It was not immediately clear if the post meant Trump was referring to the scheduled end of Powell’s term, or if Trump was seeking to remove Powell as chair. The White House didn’t immediately respond to a request for comment. A Fed spokesperson declined to comment.

Powell’s term at the Fed’s helm runs into May 2026, while his term as a governor lasts until February 2028. Trump’s comments come a day after Powell, speaking in Chicago, reiterated that the Fed isn’t in a rush to cut rates and instead is awaiting greater clarity on the economy.

Senate Minority Leader Chuck Schumer condemned the president’s comments, posting on X that “an independent Fed is vital for a healthy economy— something that Trump has proved is not a priority for him.”

The president’s ability to remove top officials at agencies that had long been viewed as having a measure of independence from the White House has come into acute focus in recent months, after the administration dismissed senior officials at the Federal Trade Commission, the National Labor Relations Board and Merit Systems Protection Board.

The firings are the most direct challenge yet to a 1935 Supreme Court decision that paved the way for agency independence. Powell made reference Wednesday to a current Supreme Court case with regard to the removal of the NLRB and MSPB officials.

“There’s a Supreme Court case. People will have read probably” about it, Powell said in answering questions at the Economic Club of Chicago. “That’s a case that people are talking about a lot. I don’t think that decision will apply to the Fed — but I don’t know,” he said. “It’s a situation that we’re monitoring carefully.”

Powell also reiterated his argument that “our independence is a matter of law,” and that the Fed’s statute shows that there’s “not removal except for cause.”

Treasury Secretary Scott Bessent earlier this week indicated that the administration’s timeline for considering Powell’s successor was roughly six months away. Speaking in a Bloomberg Television interview, Bessent said that the timing for interviewing candidates to replace Powell was “sometime in the fall.”

Bessent also said that Fed independence in deciding on monetary policy was a “jewel box that has got to be preserved.”

The latest broadside from Trump on the Fed recalls criticism he heaped on Powell during the president’s first term, when he repeatedly blasted Powell and his colleagues for not easing policy quickly or strongly enough for his liking.

Trump’s recent moves to ramp up tariffs on the rest of the world have raised concern about slowing domestic growth and price increases, making the Fed’s policymaking all the more challenging. In his speech Wednesday, Powell reiterated his view that the Fed must ensure the import duties don’t trigger a more persistent rise in inflation.

Conflicting views

“Our obligation is to keep longer-term inflation expectations well anchored and to make certain that a one-time increase in the price level does not become an ongoing inflation problem,” Powell said.

Trump has argued instead in favor of lowering borrowing costs — something that might help any businesses looking to boost domestic production behind the new tariff wall the administration is constructing. But most economists see inflation as still too high for policymakers to take that step.

As in his first term, Trump compared the Fed with the European Central Bank, which on Thursday lowered its benchmark rate by a quarter point to 2.25%. His post came just before that anticipated move.

“And yet, ‘Too Late’ Jerome Powell of the Fed, who is always TOO LATE AND WRONG, yesterday issued a report which was another, and typical, complete ‘mess!’ Trump wrote. “Too Late should have lowered Interest Rates, like the ECB, long ago, but he should certainly lower them now.”

He added that oil and grocery prices are down, and that the US is “getting RICH” on tariffs.

While crude oil is down well over 10% so far this year, food prices have been climbing. Groceries are up 2.4% over the past 12 months.

Asked about the Fed in her press conference Thursday, ECB President Christine Lagarde said, “let me just say very squarely that I have a lot of respect for my esteemed colleague and friend Jay Powell.” She also highlighted the history of consultation between the Fed and ECB and pledged that would continue.

(With assistance from Vince Golle, Erik Wasson and Zoe Schneeweiss.)

©2025 Bloomberg L.P. Visit bloomberg.com. Distributed by Tribune Content Agency, LLC.

Comments