A new Trump administration rule aims to combat money laundering. A California woman says it will put her out of business

Published in Business News

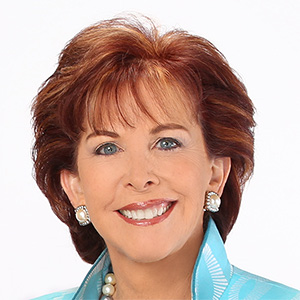

A San Diego small business owner sued the Trump administration on Tuesday over a new financial reporting requirement, arguing that an order the government says will help crack down on money laundering by Mexican cartels instead violates the Fourth Amendment and will financially ruin money services businesses like hers.

Money services businesses, which provide check cashing, money transmitting, foreign currency exchange and other similar services, are already required to report all transactions of $10,000 or more in an effort to combat money laundering. But the new rule, which took effect Monday, requires those businesses in 30 targeted ZIP codes in California and Texas, including seven in San Diego County, to report all transactions of $200 and over.

Business owners said that would essentially mean submitting reports for every transaction, which would become prohibitively time-consuming. It would also require customers to turn over sensitive information such as their names and Social Security numbers, raising concerns that the Trump administration could use that information in its immigration crackdown.

The U.S. Department of the Treasury’s Financial Crimes Enforcement Network, known as FinCEN, announced the new “geographic targeting order” last month, stating the order is aimed at “further (combatting) the illicit activities and money laundering of Mexico-based cartels and other criminal actors along the southwest border.”

But Esperanza Gomez Escobar, the owner and manager of Novedades y Servicios Plus in San Diego’s Southcrest neighborhood, argued in her lawsuit filed Tuesday in San Diego federal court that the new reporting requirement “will sweep up information about countless everyday transactions” in violation of the Fourth Amendment. She and her attorneys also argued the new order will impose “crushing costs” on the targeted businesses and their customers while still allowing anyone wishing to circumvent the reporting requirement to simply go to a business located in one of the many nearby ZIP codes not covered by the new rule.

“This cash surveillance order casts a staggeringly wide net, but it will catch no big fish,” said Rob Johnson, a senior attorney with the public interest law firm Institute for Justice that is representing Gomez and her business. “To the extent that criminals are moving money in $200 increments, they will just move that money to ZIP codes not covered by the order. But, meanwhile, ordinary people will have their private information suctioned into the government’s database, while small businesses will be destroyed by mountains of paperwork.”

Gomez’s lawsuit seeks to immediately bar FinCEN from being able to enforce the order and to eventually have the order struck down and declared unconstitutional.

The defendants named in the lawsuit are FinCEN and its director, Andrea Gacki, as well as the Department of the Treasury, Secretary of the Treasury Scott Bessent and Attorney General Pam Bondi.

Officials from FinCEN did not immediately respond Tuesday to a request for comment on the lawsuit, but government attorneys defended the new rule last week in a similar federal lawsuit filed in San Antonio by the Texas Association for Money Service Businesses.

The federal judge overseeing the Texas case issued a temporary restraining order Friday barring FinCEN from enforcing the new rule, writing the plaintiff had shown “it will suffer immediate and irreparable harm absent emergency injunctive relief, including the threat of business closure, reputational injury, and loss of customers and goodwill.”

The injunction only applied to the 10 specific Texas businesses who make up the plaintiff association in that case, but Gomez is hoping for a similar outcome for her San Diego case.

“This is a family business … and we’ll have to close if this (order is enacted),” Gomez said during a virtual news conference Tuesday morning.

“It doesn’t make sense that it’s only affecting certain ZIP codes, and not all of them, and certain border cities, and not all of them,” added Gomez’s daughter Frida Quetzalitl, referencing that the new rule does not apply to any areas of Arizona or New Mexico.

The impacted ZIP codes in San Diego County cover downtown San Diego and several nearby neighborhoods, including Barrio Logan, Logan Heights, Mountain View and Southcrest, as well as portions of Clairemont and Mira Mesa. Most of the border region of San Ysidro and Otay Mesa is also covered, as is a northern portion of Chula Vista.

In issuing the order, FinCEN did not explain why it was targeting those specific ZIP codes, except to say that the new rule “supports work to counter drug trafficking organization activity and transnational criminal organization activity.”

Gomez’s lawsuit contends that an internal FinCEN memorandum produced as part of a different case showed FinCEN was targeting those ZIP codes based on high proportions of transactions over $10,000, which trigger mandatory “currency transaction reports.”

Johnson, the Institute for Justice attorney, said that reasoning doesn’t make sense.

“There’s no allegation that all of those over-$10,000 transactions are in any way criminal, and even putting that aside, the fact that there are lots of $10,000 transactions isn’t a reason to require this sweeping, burdensome reporting on $200 transactions,” Johnson said Tuesday.

In addition to submitting mandatory reports for transactions over $10,000, money services businesses are also required to collect and retain some customer information for transactions over $3,000, though they’re not required to submit reports on those transactions.

Gomez said the vast majority of transactions she processes are less than $3,000, and she has never processed a transaction of more than $10,000 in the five years she’s been in business.

“Most Novedades customers are regulars who use Novedades’ services to do perfectly normal, legal things, such as cash payroll checks, pay rent, and send money to family,” the lawsuit contends.

In addition to the Fourth Amendment claim, the lawsuit alleges FinCEN’s order violates the Fifth Amendment right that Gomez and her customers have against self-incrimination and that it violates the Administrative Procedure Act and other federal rules that bar executive-branch agencies from making policy decisions that should be made by Congress.

©2025 The San Diego Union-Tribune. Visit sandiegouniontribune.com. Distributed by Tribune Content Agency, LLC.

Comments