'The anti-trust tides have turned.' What a judge's ruling over Google's 'monopoly' on ad-tech means

Published in Business News

In another major legal blow to Google, a federal judge on Thursday ruled that the search giant held an illegal monopoly over some advertising technology, a ruling that could reshape the online advertising business.

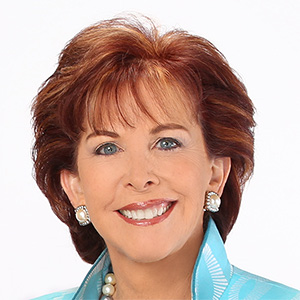

Judge Leonie Brinkema of the U.S. District Court for the Eastern District of Virginia said in a decision that Google illegally maintained and acquired a monopoly in two markets for advertising technology — publisher ad servers and the market for ad exchanges.

But in a partial win for Google, antitrust enforcers failed to prove that the company held a monopoly in advertiser ad networks, the judge found.

The highly anticipated decision could reconfigure the online advertising business that website publishers rely on to fund the creation of content. It also underscores how the U.S. government has been trying to rein in the power of Big Tech, which collects a trove of data on its users to fuel its advertising businesses.

Google’s anticompetitive conduct “substantially harmed Google’s publisher customers, the competitive process, and, ultimately, consumers of information on the open web,” the judge wrote in the 115-page decision. She described digital ads as the “lifeblood of the Internet” that made it possible for people to use some of the world’s most popular websites without paying a subscription fee.

The ruling marks the latest legal setback for Google. In August, a judge ruled in a separate case that Google maintained a monopoly in online search.

The media industry praised the decision, contending that Google’s monopoly forced publishers to use its services and that the lack of competition has led to fewer ad dollars.

“Publishers are excited because they’re hoping to get more money for what they’re selling, and the advertisers should be happy too, because they’re going to have to pay less for it. That’s going to be the goal of restoring competition,” said Rebecca Haw Allensworth, a professor at Vanderbilt Law School who studies antitrust law.

Still, antitrust experts said the ruling’s effect on journalism and advertisers will depend on how the judge decides to restore competition.

The judge hasn’t decided on potential remedies, which could force the sale of its Chrome web browser. Google plans to appeal both decisions.

The latest ruling comes the same week that a landmark antitrust trial between Facebook’s parent company Meta and the Federal Trade Commission kicked off.

“The bigger picture is crystal clear: the antitrust tides have turned against Google and other digital advertising giants,” Evelyn Mitchell-Wolf, a senior analyst at Emarketer, said in a statement.

In 2023, the U.S. Justice Department and several states including California sued Google, alleging that the tech company engaged in illegal behavior to squash its competition in advertising technology. Google’s growing control over advertising technology resulted in website creators earning less money and advertisers paying more, according to the lawsuit.

Publishers use advertising technology products to sell ads to businesses that market their products online to potentially reach more customers. Advertisers also use tools to bid for online ad space, telling tech companies such as Google how much they’re willing to pay to get their ads displayed on websites.

Website publishers such as news outlets heavily depend on ad dollars to fund their businesses and the creation of content. Digital display advertising generated more than $20 billion in revenue per year for U.S. publishers, the lawsuit said.

The lawsuit further alleged that competition in the advertising technology space is “broken” because Google purchased its rivals and used tactics that bullied publishers and advertisers to use its tools.

Google has control over popular advertising technology services that most major publishers use to sell ads and that businesses use to buy ads. The company also runs what’s known as an ad exchange that helps match publishers with advertisers who are competing with one another to buy up available ad space.

Additionally, Google collects valuable data about its users, allowing advertisers to target people based on location, interests and what they’re researching.

Because Google wields so much power over online advertising, the company was able to set rules and manipulate the system in ways that benefited itself and harmed rivals, the Justice Department alleged in its lawsuit. It keeps an estimated 35% of every dollar spent on digital advertising.

In the ruling, the judge said that Google forced its customers to use its product by tying together its publisher ad server and ad exchange. The judge could order Google to change policies that prevented publishers from using other ad tech products.

“Google’s monopolistic tactics — this time in the advertising market — have starved content creators of the revenues they deserve and need to sustain quality journalism. Today is a big day for our industry,” Danielle Coffey, president and chief executive of the News/Media Alliance, a trade group representing media outlets, said in a statement.

Google, on the other hand, says it does have rivals. During the trial, Google’s lawyers argued that the government focused its case too narrowly on certain ads displayed on websites, ignoring the tech giant’s competition with social media platforms, streaming services and e-commerce giants such as Amazon.

“We won half of this case and we will appeal the other half,” said Lee-Anne Mulholland, vice president of regulatory affairs at Google. “We disagree with the Court’s decision regarding our publisher tools. Publishers have many options and they choose Google because our ad tech tools are simple, affordable and effective.”

The court battle featured company executives including Neal Mohan, CEO of Google-owned YouTube, who testified that Google expanded the ad tech tools it offered in response to customers’ demands.

Mohan used to work at online ad company DoubleClick and joined Google after it closed its acquisition of the company for more than $3 billion in 2008.

Google’s purchase of DoubleClick, which offered services that helped advertisers and publishers manage and track online ads, helped Google grow. As publishers looked for ways around using Google’s products, the search firm also purchased potential threats such as Admeld that helped publishers get better prices for their ad space.

Although the judge still could order Google to divest those acquisitions, antitrust experts say it’s less likely than other possible fixes.

That’s because the court found that antitrust enforcers failed to prove that Google’s DoubleClick and Admeld acquisitions were anticompetitive, even though they helped the company gain a monopoly in two ad tech markets.

“Structural remedies like that are somewhat disfavored. They’re seen as being sort of drastic, and so that’s why I would put [the likelihood] at maybe under 50% but not at all impossible,” Allensworth said.

©2025 Los Angeles Times. Visit at latimes.com. Distributed by Tribune Content Agency, LLC.

Comments