Republicans could reach SALT compromise Wednesday, Johnson says

Published in Political News

WASHINGTON — House Republicans could land on a compromise on the state and local tax deduction on Wednesday, a deal that would represent a breakthrough in one of the thorniest policy debates in President Donald Trump’s economic package.

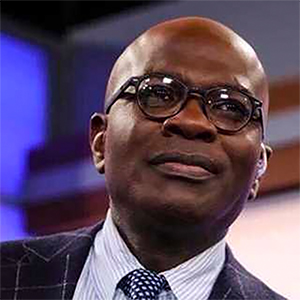

House Speaker Mike Johnson told reporters Tuesday evening that a deal on SALT will “likely be tomorrow.” He spoke after meeting with lawmakers from New York, New Jersey and California who have threatened to sink the bill unless it calls for a significant expansion to the deduction.

The House Ways and Means Committee is debating a proposal Tuesday evening that calls for increasing the SALT cap from $10,000 to $30,000, phasing out for individuals who earn at least $200,000. But several lawmakers have already rejected that plan, saying it doesn’t do enough to reduce the tax burden for constituents living in their high-tax districts.

Representative Mike Lawler, a New York Republican who attended the meeting with Johnson, said that the two sides are “making progress.” But another advocate for SALT, Representative Nick LaLota, said the proposals floated are still very far from what he wants.

“More sizzle than steak in that meeting,” said LaLota, who represents a district on Long Island, New York.

The standoff over SALT is one of the remaining sticking points as Republicans seek to advance Trump’s tax cut bill through the House in the coming weeks. The legislation would renew the president’s first-term tax cuts and calls for a new round of reductions, including eliminating taxes on tips and overtime pay.

Lawmakers said they had given new proposals to be evaluated by Congress’ official scorekeeper. The bill so far adds $3.8 trillion in deficits, less than the $4.5 trillion limit lawmakers have given themselves. That leaves room to expand the SALT cap.

Johnson said doubling the cap for married couples is under consideration.

_____

©2025 Bloomberg L.P. Visit bloomberg.com. Distributed by Tribune Content Agency, LLC.

Comments