Discount retailer Five Below has stopped importing Chinese goods, its largest source of merchandise

Published in Business News

PHILADELPHIA — Five Below, the 1,500-store chain that grew rapidly by selling cheap sunglasses, LED watches, and many other brightly colored Chinese-made items has paused its Chinese imports, citing the rapid rise in U.S. tariffs that have more than doubled costs on new inventory.

“In order to ensure maximum flexibility, we proactively paused orders from China, given the escalation in the tariffs, as we evaluate all options” to find “trend-right products” at attractive prices, Five Below said in a statement.

Shipping giant Moller-Maersk A/S told Five Below’s China factories to take back all shipping containers sent to ports since April 10 and not send any more, Bloomberg LP reported.

Sourcing merchandise elsewhere

The stock fell Friday on the news but closed up more than 5% Monday at $63.56, down from over $200 in early 2024. The stock has fallen over the past year as Five Below reported disappointing sales and slowed store openings and replaced top managers.

“We are utilizing several tools to help mitigate tariffs and swiftly assessing the best of many available options,” the company added in its statement.

In a filing last month with the U.S. Securities and Exchange Commission, Five Below anticipated that “tariffs imposed by the U.S. government could increase the cost to us of certain products, lower our margins, increase our import related expenses, cause us to increase our prices to consumers and reduce consumer spending,” hurting Five Below sales and profits.

“A significant majority of our merchandise is manufactured outside of the United States, with China as the single largest source of merchandise we import and source from domestic vendors,” the report said.

Five Below said it would try to fight back by negotiating lower supplier prices, finding products from any countries that don’t face U.S. tariffs, boost its own retail prices, or find new U.S. product sources.

Besides the direct impact on Five Below imports, higher tariffs by the U.S. and “retaliatory” tariffs by other countries are likely to inflate U.S. prices, causing consumers to buy less and further hurting retail sales and profits, the company said.

Struggling before tariffs

Even before President Donald Trump’s election last fall and his move to boost China tariffs — which now total 145%, or a $1.45 import tax for every dollar an item is worth — Five Below has struggled.

The chain was one of the few that kept expanding during the retail store consolidation of the late 2010s and the COVID shutdowns of the early 2020s. Last year cofounder Thomas Vellios stepped back into an executive role on the company’s board as CEO Joel D. Anderson and other senior officers departed.

Vellios slowed Five Below’s planned growth from a former target of 260 stores this year to around 150 and announced a return to offering simpler, cheaper items, reversing Anderson’s trend toward larger stores and more expensive merchandise.

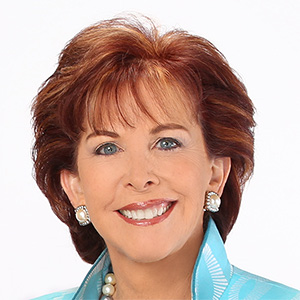

Five Below appointed Winnie Park to the chief executive role in December. Park previously served in the top job at PaperSource and Forever21.

©2025 The Philadelphia Inquirer, LLC. Visit at inquirer.com. Distributed by Tribune Content Agency, LLC.

Comments